My daughter joked growing up that I was over preparing her to handle finances. She had a checking and investment accounts as a teen, access to credit cards, learned to write checks and budget purchases before she left for college. She was skilled at negotiation, confident enough to walk away from a deal and knew how to use consumer reports and online reviews.

The skills came to a test last week. She called daily with details of her search in State College (where she has lived for six years) for a new car. She spent a week online in research then called after the day she spent test driving five car she had chosen. She shared with me the details of her investigation of interest rates, trade ins, the respect granted by the salespeople and insurance premiums. She made her decision and finalized the details with a salesperson who was kind, respectful, and a delight to work with. And then she found herself at 26, alone in a car dealership, having to fend off an overly aggressive finance manager who was refusing (after an hour of repeated no’s) to accept her refusal to purchase extended warranties and other extras. Embarrassingly, she resorted to calling her mother in the midst of being brow beaten. I was dumbfounded to discover that despite the call and yet another polite refusal, the man continued to pressure her. She finally resorted, after another half hour, to standing up and threatening to leave. She ended up with the Hyundai Elantra at the price she wanted, but drove away from the Blaise Alexander dealership in State College completely frustrated by the way she was treated.

Studies, undertaken since the 1980’s, reveal that women get ignored, patronized, and overcharged at car dealerships, despite buying the majority of cars, The way the studies are conducted, where men and women both follow a script of questions and responses, women and minorities are quoted prices that are $150 to $1500 higher. I thought this was a battle we had won in the 80’s, but evidently, according to recent articles and blogs in Forbes, the New York Times, and the Huffington Post, women and minorities remain dissatisfied and charged more than white male counterparts at car dealerships.

It is a parent’s job to prepare any child for financial decisions. Financial literacy is rarely a topic in school. When it is, it is rarely handled comprehensively. I’ve developed a checklist for financial literacy to serve any parent trying to fill the gaps of their child’s ability to become financially independent. The checklist is adapted from the National Standards in K-12 Personal Finance Education.

The Grow a Generation Checklist for Financial Literacy

adapted from the National Standards

in K-12 Personal Finance Education

Financial Responsibility and Decision Making

____ Does my child take responsibility for personal financial decisions (for example, do they pay their own phone bill)?

____ Can they find and evaluate financial information from a bank statement, credit card statement, credit score, loan application, and investment portfolio? Curriculum suggestion: Bankit

____ Do they know their rights as a consumer and where to turn when a merchant does not obey consumer protection laws?

____ Have they practiced making financial decisions by systematically considering alternatives and consequences.

____ Are they comfortable asking questions and discussing financial issues?

____ Do they know which personal information to control, restrict, and monitor?

____ Can they use financial software such as Quicken, Online Banking, and Financial Investment tracking apps?

Income and Careers

____ What career options have they explored? What are the job prospects and income potential?

____ What are their sources of income and can they calculate how much is disposable income?

____ Can they read a pay stub and understand the things that affect “take-home” pay?

____ Have they learned to set a limit to impulse buying?

Planning and Money Management

____ Can they develop a budget? (Check out Joseph Hogue’s great post on setting financial priorities and a budget you can keep).

____ Have they developed a plan to save money for large purchases and for “rainy day” fund?

____ Do they have a system for keeping and using financial records.

____ Can they write a check, use a credit card, pay online and protect themselves from credit card theft?

____ Do they know how to compare prices, read reviews, and make good purchase decisions? (I would add do they know how to recognize sales manipulation techniques?) Curriculum suggestion: Propaganda strand of Academic Games

____ Do they make donations to worthy causes (and know how to check for credibility in charitable requests).

____ Do they know the components of a personal financial plan and a schedule to annually review it.?

____ Do they understand the mental weight of debt?

____ Do they recognize the mental illness involved in hoarding and compulsive shopping disorder and know where to turn for support and help?

Credit and Debt

____ Have they applied for credit card, unsecured and secured loans with help to identify the questions to ask?

____ Can they order and read a free credit history and take steps to protect their financial reputation?

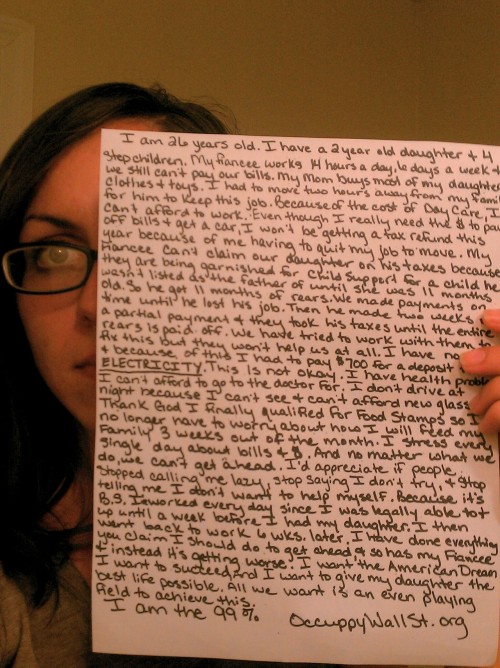

____ Have they read through at least ten stories of young people ten years older them themselves that have posted on WeArethe99percent. Have you discussed with them how to avoid and correct debt problems?

____ Can they tell you why the Consumer Credit Protection Act was needed?

Risk Management and Insurance

____ Can they envision worse case scenarios for their health, their property, their virtual identity, and their personal liability?

____ Do they understand how to research, read, and purchase health, disability, property and liability insurance coverage? (Do they have a renter’s policy on their college apartment? Do they pay their share of the auto insurance and understand the terms of the insurance?)

Saving and Investing

___ Have they establish a rainy day or emergency fund of at least three months of bills?

___ What are their financial goals for education, large property purchases, and wealth accumulation? (Have you shared with them the larger picture of your successes and failures in retirement planning?)

___ Have they sampled different types of investment opportunities (stocks, bonds, real estate, commodities, precious metals, etc.), including how to buy, track and sell. Curriculum suggestion: The Stock market game for 4th-12th grade.

___ Can they read and understand the after tax rate of return on an investment?

___ Do they realize that lottery tickets, gambling systems, and pyramid schemes are not investments, carry high risks, statistical improbabilities, and the potential for addiction.

Some practices from our home:

Bank Accounts:

Banks are no longer allowing anyone under 18 to open a bank account. We opened a specific account in my name and set my child as the manager who has to balance statements before they leave for college.

Credit Cards:

As young as twelve, take out a credit card just for them and have the company issue your child a card. Have them charge and pay off their bill. Teach them how to use a credit card online and at ATMs and create an alert to receive an email any time their credit card is used. Walk them through how to create a physical portfolio of financial information to refer to if they need to quickly inform credit companies and banks about stolen wallets or unauthorized access.

According to the statistics provided in 2012

by the Federal Reserve Survey of Consumer Finances,

US Census Bureau, Sallie Mae, Com Score, Experian:

76% of undergraduate students have a credit card

The average credit card debt of undergraduate students is $2200

Investments

When my father died, each child was given a small amount of money as an inheritance. I sat with both of them to help establish online investment accounts. (As they were under 18, the accounts were originally set up in my name). The Stock Market Game made one confident to play with some high risk investments. Otherwise, both choose surprisingly conservative funds and continue to invest and track their gains and losses.

Chutzpah

Chutzpah

Finally, make sure that your daughters know that they are, sadly, still discriminated against. They need to approach big purchases and negotiations with research, backbone, and chutzpah. Chutzpah is a Yiddish word – it is not usually considered an attractive description, particularly for a girl. It is a description of Darla Moore, not Princess Diana. It describes someone who is willing to step over the boundaries of accepted behavior. Gall, effrontery, and brazenness associated with chutzpah are not traditional ‘female’ qualities, but they are qualities our daughters need to financially survive and thrive in the 21st century.